QuickBooks Corner: QuickBooks Desktop Plus 2022 Paying Vendor Bills Online & Payment Approval

Contents:

On the “noye’s circle of criminal croniess” tab, you enter items or services purchased, with their costs and descriptions being pulled from the purchase-side fields of items in your item list. If you’ve set default terms on the vendor, they’ll be filled in when you choose the vendor for the bill. Otherwise, if they’re not set or you need to use some terms other than the default, you can select them in this field. As with most lists on transaction forms, you can add to this list on the fly – if needed. To learn more about this feature you should watch the YouTube video, ‘How to pay bills online with QuickBooks Desktop’ to see this feature in action. Select either Bank transfer (ACH/EFT) or a paper check.

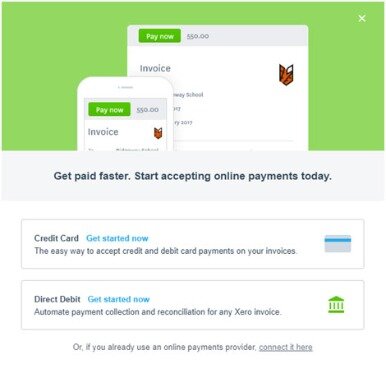

You can now pay bills by either printing checks or using the free QuickBooks Online bill payments feature. The next tutorial in our QuickBooks Online Training Course is How to Enter Bank Transactions in QuickBooks Online Manually. QuickBooks Online and QuickBooks Pro can help you organize your accounting and gain control of your finances. To learn more about the QuickBooks accounting software, read our in-depth QuickBooks accounting software review. But if QuickBooks doesn’t feel right for your business, consider a QuickBooks alternative that may better suit your budget and goals.

You’ll also map the VAT codes to those in QuickBooks and select Next. Any mapping issues are highlighted, so you can always go back and make changes. During the import process, you must map each column header to the QuickBooks bill fields. If you’re moving to QuickBooks from another bookkeeping program, or have a batch of bills to enter, use the import option to save time and effort. After selecting the vendor, the date, address and other details should automatically populate.

Choose Your Payment Method

A relatively new feature enables you to track tips collected from your customers, and then pay them out to your employees or workers. You can turn on multicurrency from the gear icon under accounts and settings. You will receive a warning that this cannot be undone – the only downside of having multi currency turned on, is having extra columns appear in your reports. In addition to entering single time activities you can use the weekly timesheet feature. When you are purchasing goods and services and will be paying for them later you enter the amount you will be paying as a “Bill” in QuickBooks.

The ever-evolving software subscription model – Computerworld

The ever-evolving software subscription model.

Posted: Mon, 13 Mar 2023 16:24:00 GMT [source]

You may have noticed the bill/credit radio buttons above the bill header. When “Credit” is selected, this changes the transaction from a bill to a vendor credit, indicating that the vendor owes you. These can be used to record returns to the vendor, promotional credits, or other scenarios in which a vendor is reducing the amount you owe.

How to Pay Bills in QuickBooks Windows (Pro, Premier, Enterprise)

I am the Financial Controller behind Goshen Bookkeeping & Consulting. I help nonprofits and small businesses increase profitability one mission at a time. Put a tick beside the boxes of the bills that are to be paid. To access the settings menu, click the gear icon in the upper right corner of the table.

You can set up a recurring transaction for bills you pay regularly – especially if they have multiple lines and would not be quick or easy to categorize from the bank feed. If a vendor credit exists, QBO assumes you want to apply outstanding vendor credits to reduce the amount you owe a particular vendor. Select the check box in the column at the left side of each bill you want to pay. By default, QBO displays unpaid bills for the last year, but you can limit what appears onscreen for your consideration by a variety of dates and even for selected payees. In the Payment Account list, select an account to use to pay the bills.

Use ACH Universal to enter bills/pay bills, write checks as usual in QuickBooks – and send payment by ACH.

If you want to https://bookkeeping-reviews.com/ another bill, select Save & New. View your entered bills in the Bill Tracker, or select Pay Bills to start making payments. Most modern businesses have to deal with payables from multiple vendors for goods and services rendered, with different payment terms, due dates and other relevant details.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

The “Select All Bills” button will automatically check off and fill in the amount for all currently-displayed bills, adding them to this bill payment. If one or more bills are already checked, this button becomes “Clear Selections”, which unchecks all the bills. Funds will be deducted from the designated bank account or charged to your debit or credit card on the future date you set for payment. The Bank account or Cardholder will receive an email when the funds are processed. After you have entered bills, you can manage how and when you debit them.

You can enter bills as they come in and designate them as paid when you send the check or authorize a credit card payment or bank transfer. Besides making these records available, the software offers other ways to stay informed about the status of your accounts payable, through its Bill Tracker and assorted reports. To start paying bills using QuickBooks Desktop, go to Vendors, Pay Bills, and Schedule Online Payment. You will then have to go through the set-up options to set up your bank account with QuickBooks.

No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Gentle Frog, LLC does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Gentle Frog, LLC does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published.

Easy Ways To Cut Business Expenses

You’ll notice, too, that the toolbar at the top of the window contains links to related actions, like Attach File, Enter Time, and Pay Bill. You may identify that you are going to be short on money if you debit all of your bills immediately after they are brought into the business. Instead, you can make partial payments if necessary to manage your cash flow and keep your business running smoothly. To start this process, go to the company menu at the top and set up approval process. Follow the prompts based on your needs, and you’ll be all set!

We also have a button which will bring up the currently highlighted bill for us, in case more detail is needed before entering the payment. In the middle, we see the terms of the selected and checked bill, as well as any suggested discount QuickBooks may calculate based on the terms. To change this discount or add one that is not based on the terms, you can click the “Set Discount” button. This will bring up the “Discounts and Credits” window to the “Discount” tab. Aside from the differences in the header, entering a vendor credit is essentially the same as entering a bill.

How a £40K tax bill made SME owner turn to advisory services – economia

How a £40K tax bill made SME owner turn to advisory services.

Posted: Wed, 15 Mar 2023 23:15:13 GMT [source]

OK. You will be reminded about unpaid and overdue bills as soon as this setup gets completed. Preferences that are given below the edit menu and a new window will open. Worried about losing time with an error prone software?

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

If you charge to ship goods to your customers, and would like to easily track them separately you can turn on this feature in the Accounts and Settings. Any tips received are then recorded in a new “Tips” account set up in the chart of accounts, and can be tracked, and paid out to your employees and workers. As you select bills to pay, QBO updates the Payment column using the bill amount as the default payment amount. You can change the payment amount of any bill by typing in the Payment column.

And much like a bill, you can enter a reference number, memo, or class, for easier tracking and notation. If the vendor is sending you a check or otherwise giving funds back, that gets a little more involved. You enter the credit as usual, then you record a deposit from that vendor for the same amount from Accounts Payable and can link the credit and deposit in Pay Bills. Hello again and thanks for keeping up with all of our QuickBooks Online tutorials – I appreciate your commitment.

Here you can enter any products or services included in the bill in much the same way that you did with Category Details. Item details have extra fields for Quantity and Rate. Updating the amount will cause the total amount for the bill to change automatically.